How Equipment Financing Works for Your Business

Step 1: Equipment Selection & Application

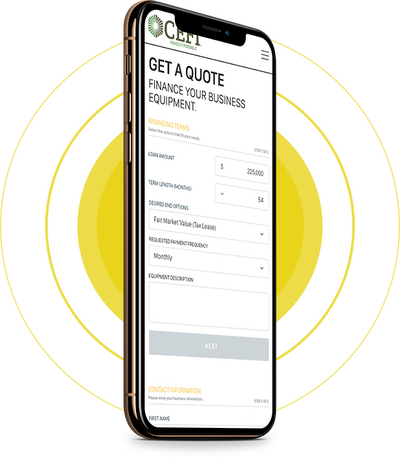

Browse and select equipment from any dealer or supplier - new or used equipment both qualify. Complete our simple online application with basic business information including revenue, time in business, and equipment details. The entire application takes just minutes to complete.

Step 2: Fast Approval Process

Our team reviews your application and provides approval decisions within 24-48 hours. We evaluate your business's overall strength, not just credit scores, and the equipment itself serves as collateral, making approval easier than traditional business loans.

Step 3: Funding & Equipment Delivery

Upon approval, we handle payment directly to your equipment supplier while you coordinate delivery and installation. Start using your equipment immediately while making predictable monthly payments that preserve your working capital for business growth.