Printing Equipment to Grow your Business

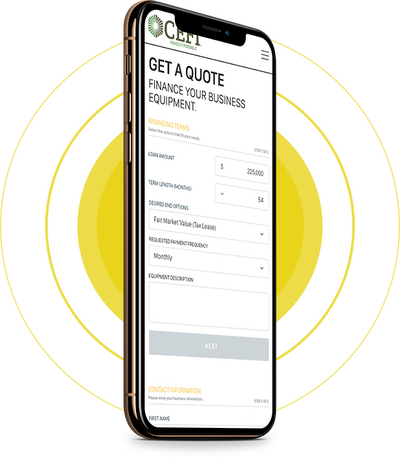

Financing can be a great way to get their Printing equipment you need for your business. CEFI USA can customize a financing program, whether you are looking for NEW and USED equipment, to fit your particular needs.