Get Approved.

Get Funded.

Get Going.

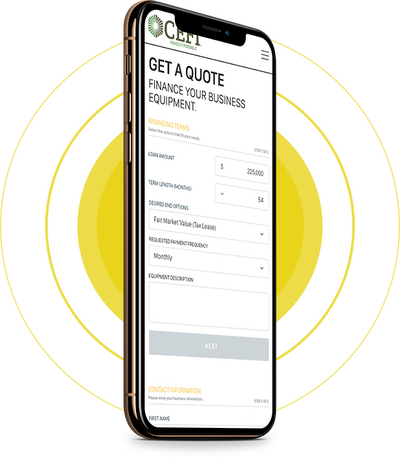

- Submit

Our simplified application process is designed to be completed in just a few minutes. - Approval

Once your application is complete, it will be reviewed and you will receive an answer within 48 hours. - Funding

Upon approval, your equipment will be funded and you can start using it to help grow your business.